By Eric Leininger

At a Glance

- The interconnectedness of the global financial system means that events in one region can have immediate ripple effects globally

- Amid volatility in early August, trading volume in CME Group futures and options rose to record highs across various asset classes

With a return of episodic spikes in volatility over the past 18 months – spurred by geopolitical shifts, the changing interest rate environment and major financial events such as the collapse of Silicon Valley Bank (SVB) — the importance of effective risk management has become critical for institutional investors.

As such, there has been an increasing need to respond to market-moving events around the clock, trading continuously and being able to access deep pools of global liquidity during non-U.S. hours (5:00 p.m. to 8:00 a.m. Central Time). This was evident during the early August volatility shock, when growth in non-U.S. hours trading volume in CME Group financial products reached new highs.

A Global Reaction

On August 1, a downturn in key U.S. economic sectors – manufacturing, construction and employment – precipitated sharp declines in major stock indices and many financial assets, triggering a significant deleveraging event in Japan. The next day, weaker than expected July nonfarm payroll data (with only 114,000 jobs added) prompted a reevaluation of U.S. monetary policy. Treasury yields plummeted as expectations for interest rate cuts surged, with CME FedWatch indicating a high likelihood of significant rate reductions by year-end.

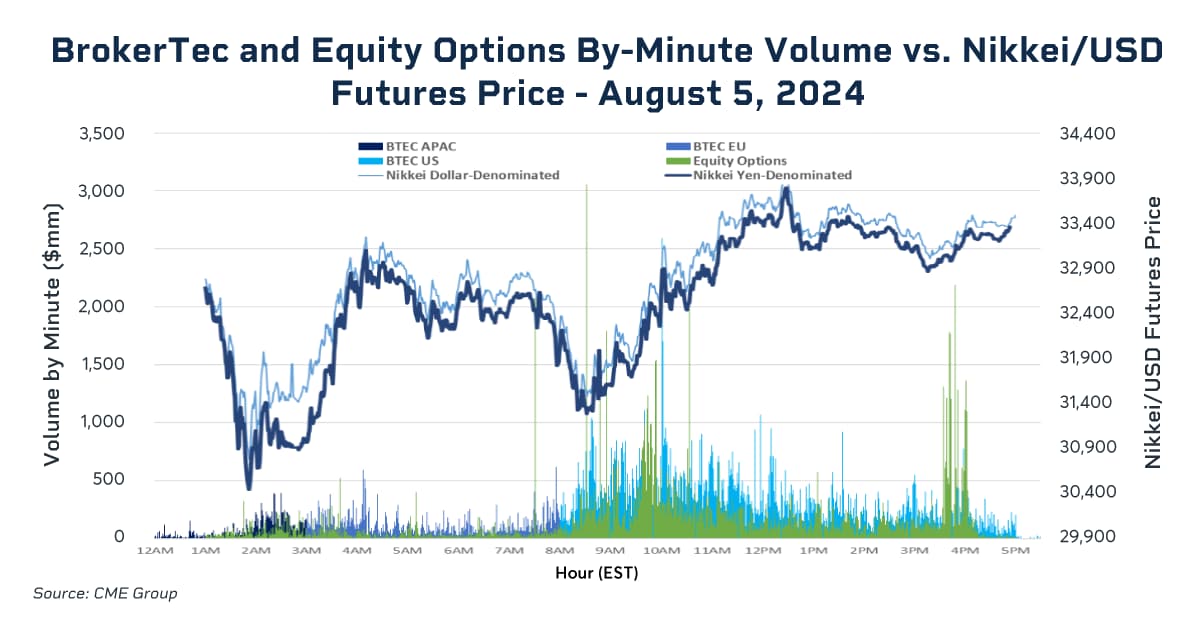

As investors evaluated the impact on their portfolios over the weekend, the interconnectedness of the global financial system was starkly demonstrated early in Asian hours on August 5, with a sharp drop in Nikkei futures and the USD/JPY exchange rate falling, signaling a stronger yen against a weaker dollar. The ripple effect led to an uptick in trading in cash U.S. Treasuries and Equity Index options during Asian and European hours to transfer risk at the earliest-possible opportunity – 12% of cash U.S. Treasuries average daily notional volume (ADNV) on BrokerTec was transacted during Asian hours on August 5, versus a year-to-date average of 4%. Equity futures and options contracts also hit a single-day volume record of 5.1 million contracts traded during non-U.S. hours.

Trading Volumes Soar

As the trading day progressed and New York markets opened, trading volumes in futures, options and cash markets increased dramatically, highlighting the pivotal role these instruments play:

Foreign Exchange: Nearly $250 billion ADNV was across a variety of FX instruments, including spot, non-deliverable forwards (NDFs), futures and options. Both EBS and FX Link recorded single-day volume highs of $145 billion (the highest since March 2020) and $13.5 billion, respectively.

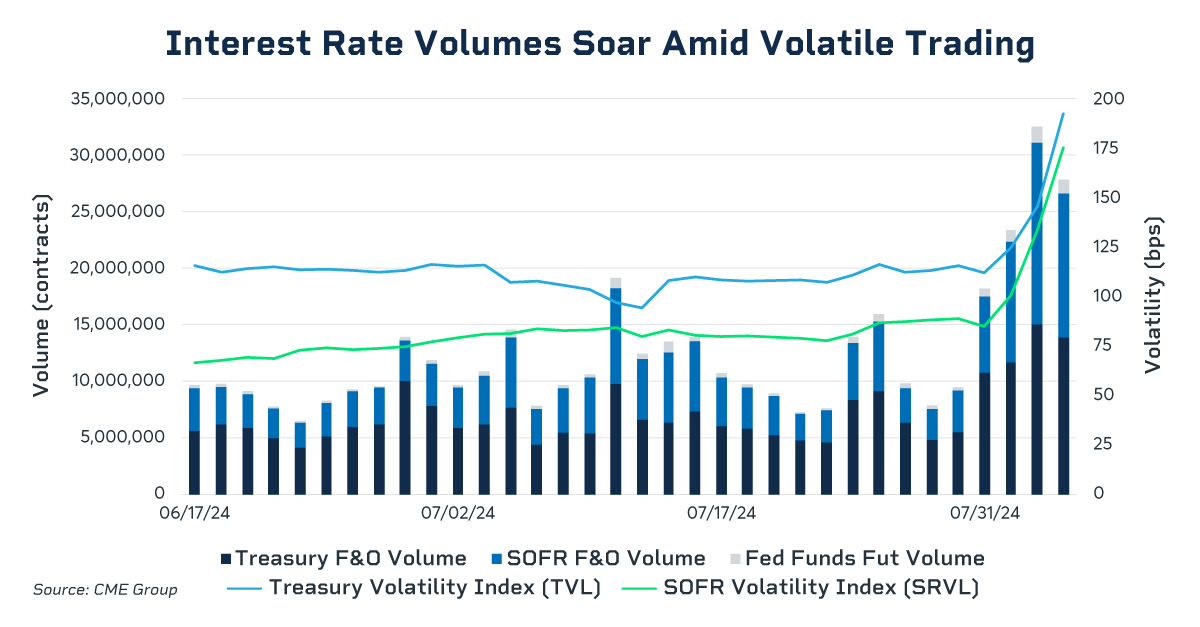

Interest Rates: Treasuries futures hit a new open interest (OI) record of 22 million contracts. This activity was a clear indication of the market’s need to hedge against interest rate volatility, which was effectively captured by the CME Group CVOL index showing a sharp rise.

BrokerTec, the platform for trading on-the-run Treasuries, played a crucial role during this period by providing continuous deep liquidity pools. On Monday, August 5, BrokerTec set a 2024 trading record of $249 billion ADNV, underscoring its significance in the Treasury market.

Equities: As volatility rose, options on equity index futures, including those on the S&P 500, Nasdaq-100 and Russell 2000, saw over 725,000 contracts traded – nearly three times the year’s average daily volume (ADV). Micro E-mini Nasdaq-100 futures achieved a record single volume day of 3.4 million contracts on August 5.

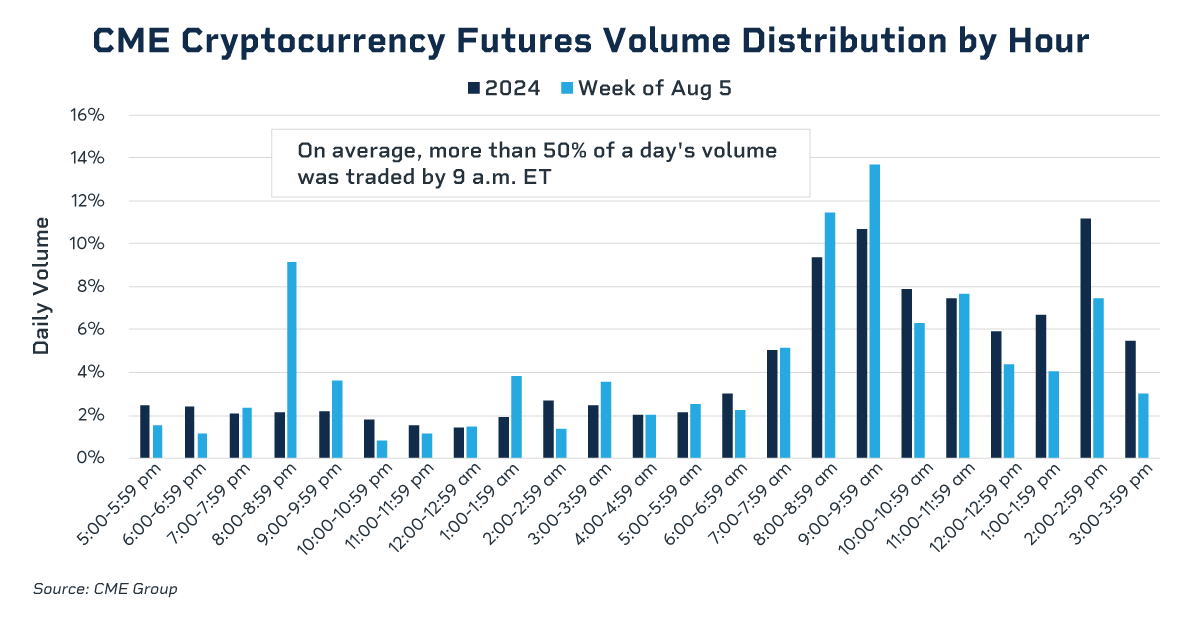

Crypto: As market volatility increased, CME Group Cryptocurrency futures and options suite set records. The hourly distribution of Cryptocurrency futures volumes illustrates how investors managed risk exposure continuously throughout the day and night.

Financial Tools Prove Vital

The significant economic shifts and market reactions in early August have underscored the essential role of financial instruments in risk management, with CME Group platforms and products providing the necessary tools for investors to navigate these uncertainties around the clock. The ability to quickly adapt and utilize comprehensive financial products will continue to be crucial.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here