Market overview

Per the MSCI AC World ex USA Index, international markets built on the strong year-to-date returns in the third quarter, gaining 8.06%. Performance within the benchmark was led by the financials and consumer discretionary sectors which posted a strong positive return, while information technology and energy sectors lagged the most.

European equities were up 6.63%, as measured by MSCI Europe Index, reaching fresh all-time highs, driven by China’s stimulus measures and the Fed’s 50 basis point (bp) rate cut. (A basis point is 1/100 of a percent.) However, optimism was tempered by concerns over sluggish growth, disinflation and political uncertainties. Several European central banks like the European Central Bank (ECB), Bank of England (BoE), Saudi National Bank (SNB) and Riksbank implemented rate cuts as economic data showed signs of contraction in the eurozone. On the heels of lower-interest rates, real estate, utilities and communication services sectors outperformed. On the other hand, falling commodity prices and a continued Chinese economic slowdown caused underperformance in energy and technology sectors.

Average annual total returns (%) for period ending September 30, 2024

|

Columbia International Dividend Income Fund |

3-mon. |

1-year |

3-year |

5-year |

10- year |

|

Institutional Class |

5.60 |

22.89 |

6.02 |

7.55 |

5.36 |

|

Class A without sales charge |

5.51 |

22.50 |

5.75 |

7.27 |

5.09 |

|

Class A with 4.75% maximum sales charge |

-0.57 |

15.47 |

3.68 |

6.01 |

4.47 |

|

MSCI ACWI ex USA Index Net |

8.06 |

25.35 |

4.14 |

7.59 |

5.22 |

|

MSCI ACWI ex USA Value Index Net |

9.26 |

24.04 |

7.49 |

7.79 |

4.28 |

|

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiathreadneedleus.com for performance data current to the most recent month end. Institutional Class shares are sold at net asset value and have limited eligibility. Columbia Management Investment Distributors, Inc. offers multiple share classes, not all necessarily available through all firms, and the share class ratings may vary. Contact us for details. |

Japan’s equity markets battled significant volatility during the quarter. The yen strengthened more than 12% against the U.S. dollar, driven by anticipation and then delivery of a rate hike by the Bank of Japan. The sharp unwinding of long dollar/short yen trades in late July caused Japan’s equity market volatility to reach multi-decade highs in early August. Initially, Japan’s markets dipped sharply on the yen’s strength before recovering equally sharply after the Bank of Japan (BOJ) made dovish comments, putting the yen back under pressure. Despite the turbulence, MSCI Japan Index still managed to gain 5.72% during the third quarter.

Fund strategy

- Aims to deliver a high level of current income, with the potential for capital appreciation, by investing internationally in companies that have historically paid consistent and increasing dividends

- Maintains flexibility to invest in any economic sector and holds at least 80% of its assets in foreign investments, including emerging markets

- Takes a collaborative and interactive team approach to integrate valuation analysis, fundamental research and behavioral views

Expense ratio

| Share class | No waiver (gross) | With waiver (net) |

| Institutional | 1.10% | 0.98% |

| A | 1.35% | 1.23% |

Top holdings (% of net assets) as of September 30, 2024

| Top holdings exclude short-term holdings and cash, if applicable. Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security. |

Top five contributors – Effect on return (%) as of September 30, 2024

| Unilever | 0.48 |

| AIA Group (OTCPK:AAIGF) | 0.46 |

| Royal Bank of Canada | 0.45 |

| Deutsche Telekom | 0.42 |

| AXA | 0.42 |

Top five detractors – Effect on return (%) as of September 30, 2024

Quarterly portfolio recap

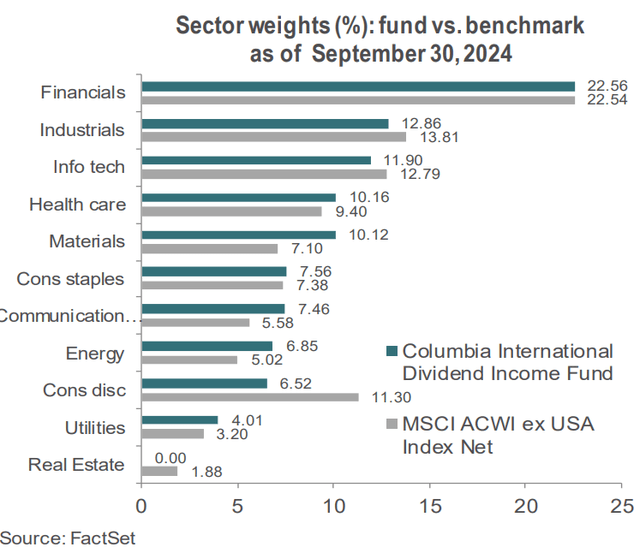

Stock selection and sector allocation both detracted from the fund’s performance relative to the benchmark for the quarter.

Positive contributions to the fund’s relative performance were led by materials, utilities and communication services sectors while the information technology, industrials and consumer discretionary sectors detracted most significantly. In country terms, the Netherlands and Spain led positive relative contributions while Japan and a lack of exposure to China detracted most from returns on a relative basis.

Within the materials sector, Swiss ingredients maker DSM-Firmenich was additive to relative returns. The company is benefiting from a recovery in volumes now that customer destocking has come to an end. On top of this, the stock received an additional boost after it was announced that a competitor in the vitamin segment would need to temporarily shut some production capacity.

Within the utilities sector, the main driver of relative outperformance was Iberdrola. The Spanish-based utilities company has seen several upward revisions to earnings guidance so far this year, most recently due to earnings accretion expected from the acquisition of Electricity North West (ENW). In addition, sentiment around growth in Spanish power demand has become increasingly positive, due to the anticipated contribution from data center demand.

Within the communication services sector, relative outperformance was led by Deutsche Telekom. The company produced a strong set of third quarter earnings and upgraded their free cash flow guidance. Shares also benefited from the strong performance of T-Mobile, in which they have a 50% stake.

Within the information technology sector, the main relative detractor was Samsung Electronics. Memory stocks were weak on concerns about smartphone and PC-related demand. As the quarter progressed, this weakness was compounded by fears that even the higher growth HBM (high bandwidth memory) market could end up in oversupply. Although competitor Micron’s bullish earnings report at the close of the quarter went some way toward debunking this view.

Within the industrials sector, SMC was a relative detractor due to concerns that a recovery in semiconductor-related capital expenditure will take longer to materialize than previously anticipated. In addition, SMC’s quarterly earnings report showed that revenues from China whilst recovering, are not doing so as quickly as hoped.

Within the consumer discretionary sector, Toyota Motor was a relative detractor and sold off as the Japanese yen saw a sharp appreciation due to anticipated changes in U.S. and Japanese policy rates. The company’s quarterly results, although mostly in line with expectations, were not strong enough to offset the negative sentiment for an exporter like Toyota related to the move in the yen.

Outlook

We continue to assess the many sources of macroeconomic and geopolitical uncertainty and how these will impact the fund.

On the macroeconomic front, there are some tentative reasons for optimism as central banks globally, led by the U.S. Federal Reserve, have begun to cut interest rates. In China, the limited stimulus measures to date have not yet been able to materially improve momentum in the economy. September saw a marked change in tone from policymakers towards a “whatever it takes” approach. We are watching closely to see what this entails and whether it will be enough to turn consumer sentiment more positive. On the geopolitical front developments in the Middle East and Ukraine have served to further increase uncertainty. For this reason, we maintain a balance in the portfolio between companies that should benefit from an improvement in economic activity and some more defensively positioned businesses.

Across all regions and sectors, we continue to look for high and growing free cash flow, sustainable profit margins, intelligent capital allocation and strong balance sheets. The focus on these quality factors has benefited the relative performance of the portfolio in times of stress and over full market cycles.

|

Investment Risks Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. International investing involves certain risks and volatility due to potential political, economic or currency instabilities and different financial and accounting standards. Risks are enhanced for emerging market issuers. Dividend payments are not guaranteed and the amount, if any, can vary over time. Investments in a limited number of companies subject the fund to greater risk of loss. Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus or a summary prospectus, which contains this and other important information about the funds, visit columbiathreadneedleus.com. Read the prospectus carefully before investing. Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies. Columbia funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA and managed by Columbia Management Investment Advisers, LLC. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate. Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any damages. Additional performance information: All results shown assume reinvestment of distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. ©2024 Morningstar. All rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating TM used to rank the fund against other funds in the same category. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly excess performance, without any adjustments for loads (front-end, deferred, or redemption fees), placing more emphasis on downward variations and rewarding consistent performance. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages). The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The MSCI All Country World ex USA Index (net) captures large and mid-cap representation across 22 of 23 Developed Market countries (excluding the U.S.) and 26 Emerging Market countries. The MSCI All Country World ex USA Value Index (net) captures large and mid-cap securities exhibiting overall value style characteristics across 22 Developed and 26 Emerging Market countries. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI Japan Index (net) is a free-float adjusted market capitalization weighted index that is designed to track the equity market performance of Japanese securities listed on Tokyo Stock Exchange, Osaka Stock Exchange, JASDAQ and Nagoya Stock Exchange. Indices shown are unmanaged and do not reflect the impact of fees. It is not possible to invest directly in an index. Information provided by third parties is deemed to be reliable but may be derived using methodologies or techniques that are proprietary or specific to the third party source. |

Original Post

Read the full article here